There is one ailment that many B2B SaaS companies, especially smaller ones, suffer from. It often costs them 1-3 times more to acquire a customer compared to the customer’s Annual Contract Value (ACV).

This, of course, is what facilitates the need for Customer Success to build lasting relationships with customers and continuously expand their accounts. This is also why, despite being considered a “sales metric,” Customer Acquisition Cost (CAC) can have a big impact on your CS efforts.

So, let’s take a closer look at CAC, why it matters, and how you can calculate, interpret, and optimize it.

What is Customer Acquisition Cost?

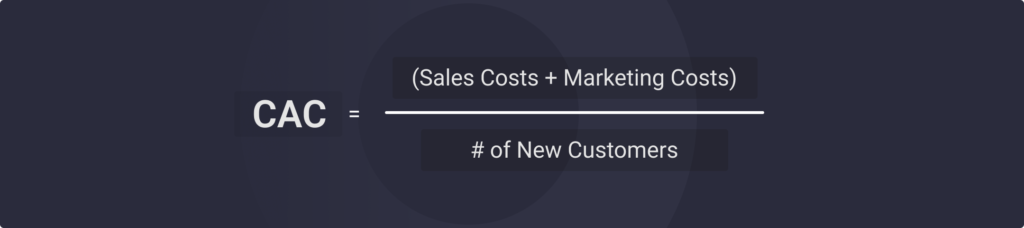

CAC is a metric that tells you how much it costs your business to sign an average new customer. It encompasses all the sales- and marketing-related costs associated with discovering, attracting, nourishing, and converting a new lead.

The formula for calculating the CAC goes as follows:

If you want to calculate your CAC accurately, you really should consider all the sales and marketing costs you undertake to sign a customer. These include your sales reps’ and marketing managers’ salaries, software subscriptions, and ad spend, just to name a few.

CAC is a useful metric for any business because it can give you a rough overview of how well your company is doing.

The logic is simple: if your cost of acquiring a new customer is higher than the revenue they will bring, you will lose money. And in the long term, that is not sustainable at all.

So, calculating and analyzing your CAC will help you figure out more cost-effective ways to attract new clients. In turn, this improves your profit margins and cash flow.

Why CAC Matters for Customer Success

Whether CAC is even relevant in Customer Success is a bit of a contested topic. Formally speaking, it’s not a CS metric as it’s only concerned with your cost of bringing new customers. Meanwhile, CS is all about maximizing the value of your existing customers.

That is why CS-related expenses are typically not considered when rounding up the numbers that make up your CAC. In terms of pure accounting, that is correct. However, your CS efforts can still help you reduce your acquisition costs in an indirect way.

I’m talking about nourishing customer advocates and champions. These passionate users can help you attract new leads in so many different ways with little explicit cost to you. They can write stellar testimonials, participate in enticing case studies, or introduce you to prospects from their own personal network.

How to Calculate & Interpret the Customer Acquisition Cost

Calculating your CAC is a bit more complicated than just plugging the numbers into the formula from above.

First, you need to choose the time period for which you want to find your acquisition cost. This will help you determine what data you should use in your calculations and give your findings more context.

You can go as global or granular as you want. CAC is typically calculated on a monthly, quarterly, or annual basis, as well as for the duration of a Sales or Marketing activity.

Then, you need to gather the relevant data for your chosen time period. Once again, to get an accurate calculation, you should include all of your Sales and Marketing costs — from salaries to subscriptions and other overheads.

As for the customer count during the time period — remember, we’re only counting the newly acquired customers! Once again, the existing customers along with their upsells and expansions are within the CS realm, and we’re not considering them for the CAC.

The data you’ll need and where you’ll get it from will depend on what type of acquisition cost you’re trying to calculate exactly.

For example, let’s say you want to calculate the overall CAC for all your Sales and Marketing activities. For that, you’ll first need to obtain your company’s global financials from your Finance team. Then, you’ll also need your customer count — which you can probably get from your CRM.

Alternatively, you might want to calculate the acquisition cost for a specific marketing campaign. In this case, you’ll again need your company’s financials, as well as the campaign metrics — namely, its total cost and the number of customers it brought.

Finally, once you get all the relevant numbers, you can proceed with calculating your Customer Aquisition Cost.

The end? Not quite.

Let’s say you rounded up every single relevant cost and found your CAC to be $300. What does that tell you? Admittedly, not much — that’s why you need more context. One thing you can do for more context is benchmark your result against the average CAC for your industry.

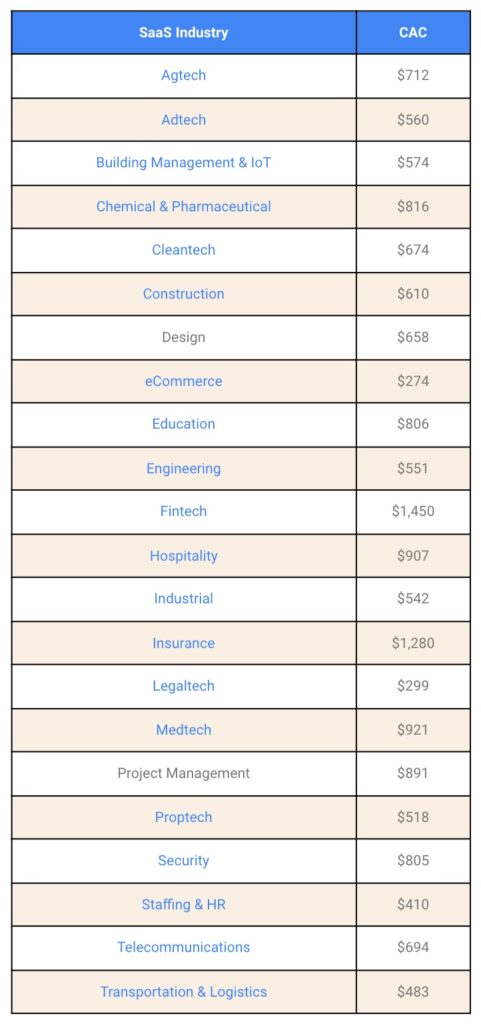

Here are a few examples of the average acquisition costs in different industries:

[Source]

[Source]

Now you know whether you spend more or less money to acquire a customer than the average business in your industry. But averages are just that – averages, and every company is different.

So, to get even more context for your acquisition costs, you should pair it with other essential metrics.

Pairing CAC with LTV & the Payback Period

When you look at acquisition cost in a vacuum, you might be compelled to see it as an evil you have to banish by any means necessary. But the truth is, costs are a necessary evil in any business — because ultimately, they are investments.

Now, what really matters is whether you get a reasonable return on your investment. And that’s where the Customer Lifetime Value (LTV or CLV) comes into play.

The Customer Lifetime Value is the projected revenue you will get from an average (LTV) or individual (CLV) customer over the course of your relationship or a given period of time.

I won’t go into too much detail on how the different components that make up the LTV, or how to calculate it. For those, check out our dedicated article!

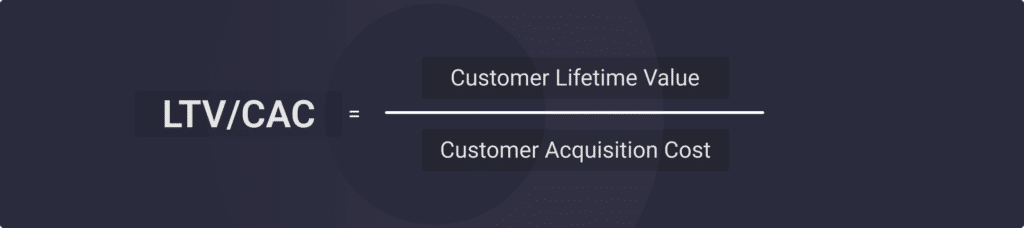

What you need to know is that when you combine LTV and CAC, you get a clear answer to the question “are my customers worth more than what it cost me to acquire them?” This is also known as the LTV/CAC Ratio, regarded by some as the single most important metric for any SaaS business.

Again, the logic here is pretty simple: if the value of a customer is high, and the cost to acquire them was low, you’re in for a good investment.

Allow me to illustrate this with an example. Let’s consider three individual companies: Company 1, Company 2, and Company 3. It costs each one of these companies $3,000 to acquire a new customer. They also have the exact same gross margins and churn rates.

How do we know which one gets more return on their investment?

When we factor in the LTV. Let’s say that Company 1 has an LTV of $6,000, Company 2 has an LTV of $9,000, and Company 3 has an LTV of $12,000.

Now, we can calculate the LTV/CAC Ratio for each company:

For Company 1, it’s $6,000 / $3,000 = 2

For Company 2, it’s $9,000 / $3,000 = 3

For Company 3, it’s $12,000 / $3,000 = 4

Company 3 is the winner here because the higher the LTV/CAC Ratio, the better. Ideally, you want it to be at least 3, which is the standard industry benchmark. If it’s under 3, you’ll still make a return on each customer, but it won’t be as significant. And if your ratio is 1, you’ll only be breaking even on each customer.

As you can see, the LTV/CAC Ratio can be extremely useful when estimating the efficiency of your SaaS business. However, you can take this analysis even further by adding another variable into the mix!

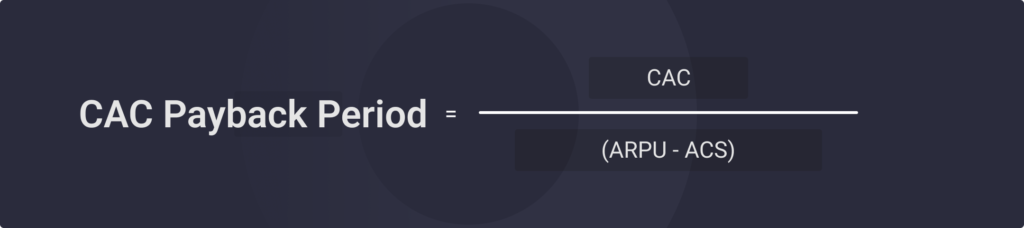

This variable is the CAC Payback Period — how long it will take you to recoup your CAC on a given customer, typically in months. The CAC Payback Period is calculated as follows:

Let’s try this out with our example. Let’s say that Comapny 1 has an Average Revenue per User (ARPU) of $700 per month, Company 2 has an ARPU of $800, and Company 3 has an ARPU of $1,300.

As for the Average Cost of Service (ACS), we’ve already mentioned that all three companies have the same gross margin. Let’s say their margin is 80%, which makes the ACS 20%. Now, let’s calculate the CAC Payback Period for each company:

For Company 1, it’s $3,000 / ($700 – ($700 – 20%)) = 21.4 months

For Company 2, it’s $3,000 / ($800 – ($800 – 20%)) = 18.75 months

For Company 3, it’s $3,000 / ($1,300 – ($1,300 – 20%)) = 11.5 months

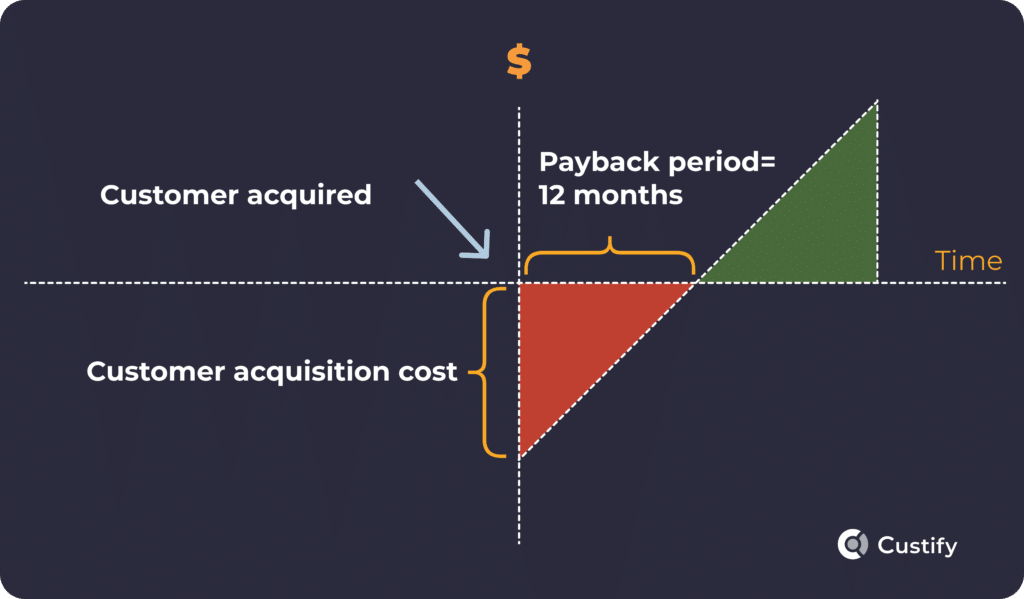

Again, Company 3 seems to be doing the best out of all three. It not only has the highest LTV/CAC Ratio, but will also recoup its initial CAC the fastest. In fact, a CAC Payback Period of 11.5 months is just under the industry standard of 12 months.

However, for the first 11.5 months, Company 3 will still be in the red — this is how the CAC Payback Period can be visualized:

Together, the CAC, the LTV/CAC Ratio, and the CAC Payback Period can help you figure out how your acquisition costs fit into your broader business goals. An objective, detailed overview of your CAC will help you figure out how to adjust your investments for the exact results you’re looking to achieve.

Especially when you break your costs down to individual Sales and Marketing channels. You can correlate these channels to your goals and adjust your strategy accordingly.

For example, if you’re looking for rapid growth, and money is no object, you can target high-cost, high-reward channels such as PPC or influencer marketing.

Alternatively, if it’s sheer company value you’re after, you should focus on maximizing your LTV/CAC Ratio and go after customers with the highest long-term growth potential.

Finally, if you need the cold, hard cash, you should look for cheap ways of acquiring new customers and minimize your Payback Period.

How to Optimize Your CAC

Now that we’ve covered the LTV/CAC Ratio and the CAC Payback Period, we can safely say that optimizing your CAC is not just about cutting costs. It’s also about getting more value from your customers faster. Here are a few ways you can achieve this:

- Keep adding value to your product: The more value you give your customers, the more value you will get from them in return. So, make sure you continuously refine and improve your product to give your customers exactly what they want — whether it’s a hot new feature or finally fixing an annoying bug.

- Optimize your conversion funnel: From the moment your prospects first hear about your product, their journey to becoming your customer should be as effortless as possible. There are numerous things you can do to optimize your conversion funnel. Make sure your website is effective in attracting and converting leads. Make your sales cycle leaner and shorter for faster turnaround. Invest in software tools that will help you identify and target leads more efficiently.

- Optimize your pricing strategically: Upon signing a new customer, you should be aiming to escape the pre-payback death zone as quickly as possible. You can achieve that by implementing a strategic pricing strategy where you get at least some cash upfront in the form of training or integration costs.

- Leverage customer referrals: As I already mentioned when talking about advocates, referrals can be a great way to offset your acquisition costs. Implement a referral program and incentivize your existing customers to spread the word about your product — a stellar review on a website like G2 or Capterra can go a long way.

Wrapping Up on CAC

Costs are inevitable and any business, and CAC is one of them. Ultimately, however, it’s a necessary evil, as customer acquisition expenses ultimately transform into a lasting revenue stream.

It’s very important that you don’t just look at your CAC in a vacuum with no additional context. Combine it with other metrics such as the Customer Lifetime Value for the LTV/CAC Ratio, and you will get a better understanding of your company’s financial workings.

Then, you will be able to optimize your Sales/Marketing efforts and pricing strategy to minimize your CAC and maximize value.