About the Churn Guide

Updated July 22nd, 2021

We’ve put together this practical, hands-on guide to help you manage churn and increase customer loyalty. In it, you’ll find a detailed analysis of the different types of churn you can expect during your business’ life cycle, as well as proven strategies and tactics to address each type.

Here’s what you can expect to learn from this guide:

- How to calculate and analyze churn for any online business

- The different types of churn from Customer and Revenue Churn to Negative Churn

- The best ways to reduce customer churn and revenue churn in a SaaS with detailed examples

Who this guide is for

We created this guide with B2B SaaS businesses in mind, but any business out there can use the tactics we describe to keep customers coming back and increase their revenue. We’ll show you how to reduce your churn and start becoming profitable.

Why you need this guide

Churn is one of the few things that can kill your business.

While in their growth stage, most SaaS companies focus on new customer acquisition – signing up as many clients as possible to gain traction. But without an effective retention strategy, you turn into a sifter – no matter how many new customers you acquire, if they don’t stay with you, you can’t grow. Or worse, you can’t even stay afloat.

Here’s why reducing churn should be your number one priority:

- businesses making more than $10 million in revenue have an average churn rate of 8.5%, while those that make less than $10 million are likely to have a churn rate of 20% or higher;

- two-thirds of SaaS businesses experience churn rates of 5% or more;

- low-growth companies are more likely to experience high churn rates;

- avoidable customer churn is costing businesses $136 billion a year.

So, how can you reduce customer churn, retain customers, and grow your revenue? By focusing on customer success!

Customer Success – the enemy of churn

Customer success means anticipating your clients’ challenges and proactively providing solutions before they reach out. It’s the main way customer success software helps you boost clients’ happiness and, ultimately, their loyalty.

No matter if you’re just getting started with customer success or you’re a veteran in this field, you can always learn something new about churn – we ourselves had our fair share of A-HA! moments while writing this guide, even after 19+ years in customer relationship-facing roles.

Are you ready to learn more about how you can increase your Customer Lifetime Value (CLV) or what KPIs you should pay attention to?

What is Churn?

Churn, or attrition, is a metric that measures how much business you’ve lost. This loss can be in:

- percent of customers – this is called customer churn and measures how many customers you’ve lost in a given period;

- or in revenue – this is called revenue churn and measures the money you’ve lost in a given period. It’s important to note that revenue churn doesn’t only measure the money lost due to customers leaving you, but also the money lost from customers downgrading their subscriptions.

Based on these 2 types of losses, churn can be classified in several ways:

- customer churn and revenue churn

- voluntary and involuntary churn

- negative churn.

Revenue and Customer churn

Let’s take a closer look at the first type of churn.

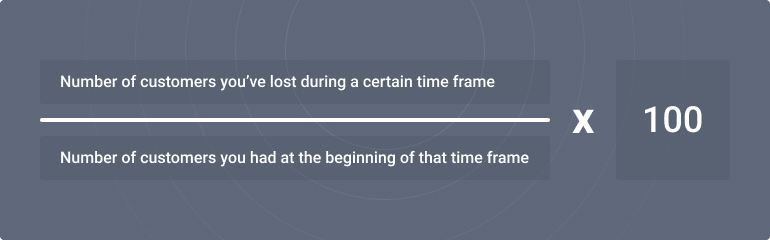

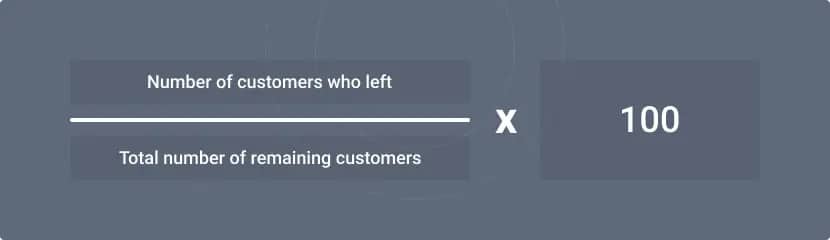

Customer churn, also known as subscriber churn or logo churn, represents the rate at which your customers are canceling their subscriptions, and it’s most often calculated in percentages. Here’s how you can calculate it:

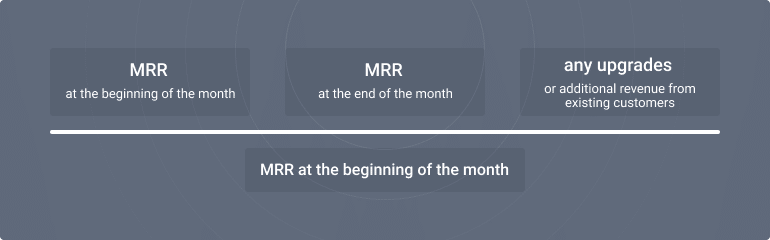

Revenue churn (also known as MRR churn), on the other hand, is most often expressed as a whole number and can mean the actual lost revenue or, more commonly, a normalized value such as MRR (Monthly Recurring Revenue). Here’s how you calculate revenue churn:

As customer churn and revenue churn are not always tied, it’s important to measure both – measuring customer success gives you context.

For example, let’s say you lose 1 customer. But what does that mean for your bottom line – $100 or $10,000? Losing one customer might not seem crucial, but you also have to consider the type of customer you’ve lost.

Not to mention that you can have 0 lost customers and still experience revenue churn (due to your current customers downgrading their subscriptions).

Voluntary and involuntary churn

Going more in-depth, we can then characterize each type of churn as voluntary or involuntary. Voluntary churn means customers voluntarily choose to spend their money elsewhere, or they’re unable to pay (if they go bankrupt, for example).

In contrast, involuntary churn means your customers don’t even know they’re churning. This type of churn is most often associated with expired or maxed out cards.

Negative churn

This is an ideal situation that only applies to revenue churn. A negative churn rate means that the revenue you generate through cross-sells, upsells, and new signups exceeds the revenue you lose through cancellations.

For example, let’s say you had $100,000 MRR at the beginning of the month, but only $80,000 at the end, and you made an additional $30,000 in upgrades. This means that you actually increased your revenue that month:

($100,000 – $80,000 – $30,000) / $100,000 = -10%

Why does churn happen?

You can’t make ALL of your customers happy – churn will always be a constant in a SaaS business’ life. Here are a few of the most common reasons why at-risk customers decide to cancel their subscriptions:

- Budgeting / finance issues;

- Their needs changed;

- They fail to see the value proposition of your product long term;

- Your SaaS fails to meet or exceed their expectations;

- Poor customer service or response rates;

- They switched to a competitor.

Some of these reasons are within your control, and some depend on external factors. That’s why a 0% churn rate is impossible to attain. However, what you can do is aim to lower your churn rate as much as possible.

We’ll go into each type of churn later in the article and give you clear insights on how to analyze and try to fix each one. For more info on why churn is critical for a SaaS business and its most common causes, check out this article.

Why is churn important for SaaS businesses?

Although churn is bad, it’s inevitable. That’s why you need to measure it and see how your business performs over time – is it growing, stagnating, or declining?

Also, it’s a lot easier (also cheaper, and more probable) to sell to existing customers. In fact, an increase in customer retention of just 5% can create at least a 25% increase in profit.

That’s because returning customers are likely to spend 67% more on your company’s products and services, which means you’ll spend less on acquiring new customers.

What is a good churn rate for SaaS businesses?

Churn rates vary vastly across industries and companies. However, for most SaaS businesses, they stay within the 5-7% range annually.

How do you deal with churn?

If your churn rate doesn’t fall within this range (or even if it does, you can always improve), you can use a number of strategies to improve customer retention.

Step 1 is analyzing your existing churn and figuring out exactly where and how much you need to improve.

How do you analyze churn?

The short answer is by performing a churn analysis.

Start by calculating your current churn rate. In theory, this seems easy; here’s a simple formula:

The problem is how do you determine the exact number of customers you had during a given period? You have customers who have been with you the previous month also, as well as new sign ups.

That’s why there’s no one-size-fits-all approach to calculating churn, but here are 4 ways you can calculate Churn Rate you can choose from, along with a Churn Calculator you can use to see whether your business is growing or not.

There are multiple ways you can calculate churn. You have subscriber churn, gross revenue churn, and net revenue churn. Also, because there are many factors that cause churn to happen, there are several types of churn analyses you can perform to determine why your customers leave you:

Cohort analyses

In a cohort analysis, customers are grouped based on their shared characteristics. Each business is unique, so there are many ways you can group your customers to extract valuable insights. Here are a few examples:

- Month of purchase

- Acquisition source (organic, paid, affiliate, etc.)

- Customer age

Customer behavior analyses

Alternatively, you can group and analyze your customers based on how they interact with your product. The most common things SaaS businesses look at are:

- Features used

- In-app actions

- Health score

- Engagement score

- Patterns

Why should you analyze your churn?

Churn is the killer of SaaS businesses. Therefore, it’s the most important metric you should track, frequently and accurately.

Left unchecked, churn leads to higher customer acquisition costs that eat away your revenue. Not to mention that what isn’t tracked and measured can’t be improved. It’s one thing to know your churn rate is 10%, and another to know why your customers leave you and how you can prevent them from doing that.

This leads us to the next point.

Voluntary churn causes and how to fix them

According to recurring billing platform Recurly, the average churn rate for SaaS businesses is approximately 5%. For worst performing companies, churn can reach 8.5%, while for best performing companies it can go as low as 2.9%.

Because churn rates vary widely from business to business, it’s difficult to understand the impact they have on your growth unless you take a step back and consider the larger picture. Here are a few tips to consider when developing a strategy to reduce your B2B SaaS churn.

By now, you hopefully know your current customer churn rate, as well as why your customers leave you. So it’s time to look at a few strategies that will help you reduce your churn and grow your business, depending on the issues you’re facing:

Cause #1: Onboarding problems

Most of the churn SaaS businesses experience happens before the “a-ha moment” (the moment when your customer finally realizes the value of your product). To avoid this, track every step in your onboarding process and define goals (like filling in their details or using a specific feature) your customers should achieve to complete the onboarding successfully.

Whenever you see a customer doesn’t achieve the goal you set for them, reach out and help them achieve it.

A good onboarding process doesn’t focus on your company’s goals. Instead, it will shift focus to meeting your customers’ needs and exceeding their expectations. When you shift focus from making sales to retaining customers long-term, you’ll be able to generate more business.

If you want to learn more about reducing churn, check out this article where we talk about why onboarding matters.

Cause #2: Wrong customer fit

Not every customer is fit for your business. Sometimes there’s a discrepancy between what you offer and what they’re looking for.

There are a few things that lead to wrong customer fit:

- your product positioning is wrong;

- your sales team oversold and set the wrong expectations;

- you’re too expensive compared to your competitors.

In this case, there’s not much you can do to prevent churn from happening. But you should use exit interviews (either online exit surveys or 1-on-1 interviews) to find out why the customer is leaving so that you can work on your product positioning.

The better you outline your buyer persona, the more accurately you’ll be able to identify whether user expectations are aligned with what you can offer, and if users use your service in the intended way. Once you find the root cause of churn, you can work with your sales team to get the right customers and work on your website to communicate the right promises.

Cause #3: Poor product quality

No product is perfect; crashes and downtime will happen. What matters is how you respond to these issues. Act fast, acknowledge your fault, and communicate the steps you’ll take to solve the issue and how long it will take.

Custify can help you with this. By integrating our customer success tool with your ticketing system, you can be notified whenever certain risk KPIs are met. Or whenever there are more than one or two open tickets marked as high severity. Although Custify does not replace a ticketing system, it can help you monitor customer satisfaction in real-time, allowing you to react fast when something goes wrong.

Additionally, you can integrate Net Promoter Score surveys. As simple as it sounds, the NPS is a powerful tool that can help you identify upsell opportunities and anticipate churn.

Remember to always have a customer success mindset – your product’s quality is crucial, otherwise, customers might switch to your competitors (this is another common issue SaaS businesses face).

Cause #4: Poor or no customer support

Customer support should be a priority. Set up multiple communication channels (phone, email, live chat) and make sure your customers can reach you in a way that’s easy for them at any stage of the customer journey.

Also, analyze the quality of support (through surveys sent after an interaction with a support rep) and the number of tickets you’re getting.

Make sure your reps know how to handle each situation and there’s a procedure in place for when the unexpected happens.

No one expects your product to be perfect; what really ticks your customers off is not the little mishaps, but how you handle them. As we’ve previously mentioned, you need to act fast and come up with a solution for your customers. Otherwise, the smallest issues could turn into deal breakers.

How to reduce involuntary churn?

Most SaaS businesses focus on voluntary churn, which isn’t always the best way of doing it. Of course, it’s important to know why your customers leave you and how you can improve your product.

However, unlike voluntary churn, involuntary churn is completely avoidable. This means that you can eliminate a big chunk of your overall churn (up to 40%) with little or no effort.

The most common reasons that determine involuntary churn are:

- expired cards;

- hard declines after fraud attempts (if the card details have been stolen before);

- soft declines after credit limit maxes;

- out-of-date billing information;

- charges not flagged as recurring.

Involuntary churn doesn’t just hurt your bottom line, but also your relationship with your customers. If they’re counting on your service for an important project and don’t notice that that service was automatically disconnected because of a failed payment, you can be sure they won’t be happy about it. They might even decide to leave you for good (meaning they churn voluntarily).

Fortunately, involuntary churn is easy to fix. Here are 3 tactics:

Method 1: Account updaters

An account updater is a service that automatically checks your customers’ card details with their issuing banks, before each renewal. On average, SaaS businesses that use this service see 2-5x improvement in recovery rate.

A word of caution here: if you use an account updater and expired card notifications, you might end up spamming your customers and that won’t play in your favor. Even worse, you could charge users that actually wanted to cancel their subscription.

Instead, try using the account updater by itself for a while and see how that impacts your involuntary churn. Then, try expired card notifications separately, and compare results.

Method 2: Dunning emails

Over time, cards expire or get stolen, misplaced, maxed out, etc., which leads to customers churning involuntary. A dunning strategy can help you prevent a significant percentage of this churn.

If you freeze customers’ accounts immediately after a failed payment, this leads to bad customer experience. Instead, you can notify them before their card expires and ask them to update it (pre-dunning).

For a maxed-out card that’s been denied, instead of freezing the account, allow your customers a few days to replace their card and try the payment again.

To ensure your customers get the best experience possible, Custify can help you automatically retry a failed payment or expired credit card and send a drip of renewal notifications to your customers whenever a charge to their credit card is declined.

Method 3: In-app lockouts

Most of the time, issues can be solved if the card is tried again or updated. But if the situation isn’t fixed by the time the grace period ends, you can consider locking them out.

Although in-app lockouts are effective, you shouldn’t lock a user out of your app immediately after their payment fails. Instead, you should allow them a grace period to sort things out.

Also, make sure to also store their data for a set period of time, in case they decide to return.

What can you learn from churn?

Sometimes, no matter how good your product is or how great a customer experience you offer, customers still choose to leave you. That’s out of your control, but what you can do is find why so you can prevent other customers from doing the same.

There are multiple ways you can do this. Here are two:

Exit interviews

Not to be confused with exit surveys, exit interviews dig deeper into patterns. Most SaaS businesses use closed-ended exit surveys to gather quantifiable data. And although they’re ok, they don’t gather the actual reasoning behind the customer churn.

If possible, use exit interviews to gather as much information about the reason your customer is leaving. You can hold the interview over the phone (this way, they can’t avoid answering) or via online questionnaires, and you use both open-ended questions or ask customers to choose from a list of predefined answers.

If you’re looking for more ideas on how to reduce churn and increase retention, check out these 14 Customer Retention Strategies.

Feedback loops

Unlike exit surveys and exit interviews, feedback loops help you prevent churn. That’s because you’re regularly asking for feedback and implementing it, and then building a product your customers love.

Feedback loops are a great tool to use when your product isn’t mature yet. They can be divided into three stages:

- Stage 1: gathering info;

- Stage 2: analyzing data;

- Stage 3: implementing changes.

Once you’ve reached stage 3, it’s time to start again.

Get started with churn reduction

Reducing churn is less about issue resolution and more about how you can implement and measure customer feedback step by step.

In this guide, we’ll teach you how to:

- analyze churn (both voluntary and involuntary);

- identify the challenges your customers are confronting with;

- address these issues and prevent churn from happening;

- learn from your churned customers and improve your service and customer experience.

Then, once you’re ready to implement real churn reducing tactics and actions, take advantage of the Custify SaaS business concierge onboarding – a service where we use our 19+ years of experience to help you get the most out of your product.

Every company is different – we make sure you always see the full picture, whether that means issues with the product, during onboarding, or with your team.

Here’s what Custify can help you achieve:

- a 360° view on customers by analyzing how they interact with your product;

- a reduced churn rate, up to under 2%;

- renewal, growth, and upsell opportunities;

- proactive customer issue resolution;

- automated outreach.